The whispers about private equity exiting the rental market are now out in the open. A few reports are highlighting that some private equity investors are testing the waters for an exit via IPOs. Some have asked why it is necessary for these investors to hold onto properties for a few years before exiting. One of the main reasons is for valuation purposes given that it takes a few years to gather enough workable data on say a block of 1,000 homes and their overall vacancy rates, rental rates, and expense ratios. This would be important if this pool of homes were to be converted into an income stream for investors. Yet many are now looking to exit given how hot the stock market is. You want to sell into momentum. A few other key points include rents falling in places like Las Vegas where investor demand has been incredibly high. Is the hot money planning an exit?

Rental prices

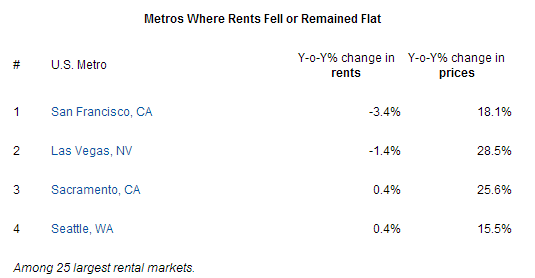

Many of the projections that I have seen assumed that rental prices would continue to move up between 3 and 5 percent on an annual basis in many locations. Yet this assumption is being put to the test in many markets as employment growth is still weak and wage growth is nearly nonexistent:

You can see that while prices continue to move up in a manic fashion, rents have fallen in some key markets including San Francisco and Las Vegas. The fall in San Francisco has to do with prices being so absurdly high to begin with but with Las Vegas, it has to do with more than over half the market being bought and sold by investor money.

Some interesting perspective on the exit of private equity from the rental business:

?(Naked Capitalism) The most popular view I heard last fall was that an exit via an IPO, with the rental business as an operating company, was the easiest and cleanest route. A portfolio of 1000 houses would be large enough to make for a decent-sized deal. But interestingly, back then, the assumption was that the portfolios would also need to have reached ?stabilized yields,? meaning they were rented up and had seen a fair number of lease renewals so investors would know the turnover, vacancy rates, and costs associated with both making homes ready for the initial rental and freshening them up when a lease expired. That would take two to three years. We are well short of that timeframe. That means that investors will be buying a pig in the poke.?

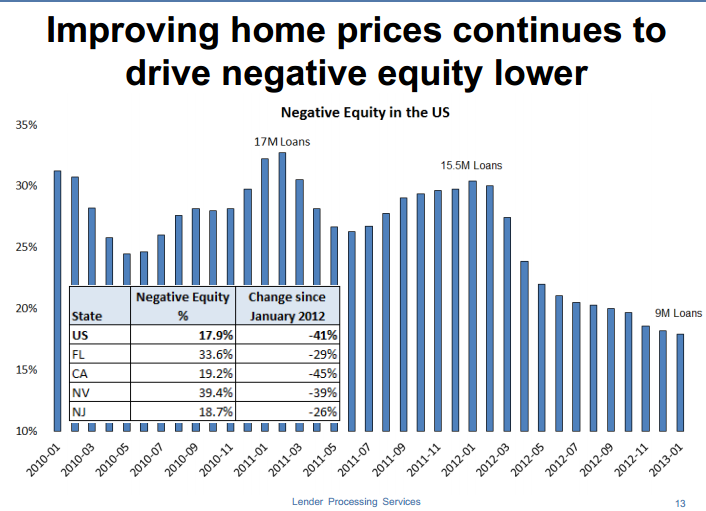

This is the primary reason for big investors to hold properties for a few years and gather enough data to package a deal. However, with falling rents, projections need to shift. As prices continue to rise, the number of homes in a negative equity position continues to decline:

Only 17.9 percent of US homes are now in a negative equity position whereas in 2012, it was closer to 30 percent. Investors and banks have a good reason to sell into this momentum especially with supply being so low. California?s negative equity percentage is down to 19 percent yet places like Florida and Nevada still have 33 percent to 39 percent of their homes in negative equity positions.

The rental market tipping point is a big deal:

?(Naked Capitalism) Now mind you, the falling rentals story is an even bigger deal than you might think. At a real estate conference at which I spoke last year, one institutional investor who was on the receiving end of PE pitches for single family rentals sniffed that many were forecasting 5% rent increases for several years running. That?s wildly optimistic given high unemployment and continuing weak wage growth.

And of course, as we pointed out in earlier posts, the very activity the PE landlords are engaging in is bound to undermine their market. Tight rental markets have resulted from many homeowners losing their house through foreclosure, as well as the properties themselves being removed from the market via the foreclosure process. Buying and converting formerly owned homes to rentals increases rental supply which reduces landlords? ability to maintain high rental rates.?

It is certainly an interesting dynamic. There certainly has been a shift between home owners and renters in the last few years:

Census 2011

Owner-occupied: 74,264,435 (64.6%)

Renter-occupied: 40,727,290 (35.4%)

Census 2007

Owner-occupied: 75,515,104 (67.25%)

Renter-occupied: 36,862,873 (32.8%)

The above addition of renters is clearly from the 5 million completed foreclosures that have occurred over the period. With foreclosure starts dropping and negative equity falling, will there be an unending supply of new renters to fill this new rental demand? Plus, in many markets across the US it makes more sense to buy than to rent given the low interest rates and subsidies that are given to home owners.

It is clear what has happened over the last few years. While the US lost some 1.2 million home owners between 2007 and 2011 it has added 3.8 million renters. I?m sure this trend has continued given the large number of rental investors purchasing homes for the specific purpose of converting them into rental units.

Wall Street and private equity money has no interest in staying in a business where cap rates are being compressed and rental prices are showing signs of weakness especially when the stock market is on a rocket ship up. Since the hot money has been in the market for a few years now, there is probably good data on overall rents, vacancy rates, and expenses for prospective investors to make a solid decision to buy a giant block of properties. The stock market is incredibly hot so there is probably no better time than now to unload into this momentum especially if the plan is to exit via an IPO. While mom and pop investors are entering the game late, the top in the rental business may be in for big money in certain markets.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble?s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble?s Blog to get updated housing commentary, analysis, and information.

?

?

(5 votes)

Jeanne Cooper Jody Arias mothers day gifts kim kardashian jaycee dugard JA Happ Tim Lambesis

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.